How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 89

No votes so far! Be the first to rate this post.

مختبرات بيتكوين بلوكشين بيروت

Please come on board

By now, the pieces of their puzzle are being set. What seems emerging from our government is nothing more than a centrally controlled CBDC. These by default run absolute customising controls allowing them to apply different interest rates to each person, even a negative one, or even to apply time limits to this currency!

After being continually lectured by our governments that digital payments should be left to the thieves, scammers, and criminals, and now they’re presenting to us exactly this.. except that it’s even far worse? Now, to say the very least, what does this tell you about the nature of our world governments?

The main concern they always voiced was “the protection of citizen’s deposits”, yes, for them to steal. I will never be interested in any CBDC.

Original post by: Hugo Lautissier

It’s a small, unassuming office tucked between a dog grooming parlour and a slot machine room in Bourj Hamoud, Beirut’s Armenian neighbourhood. Hanging on the wall are two golf clubs, three golf balls and, above them, a framed poster showing the price of bitcoin, which is rising sharply.

Continue reading “In Lebanon, Bitcoin is Proving to be a Safe Bet”#bitcoin is $55K now .. only +15% to $63K🚀 https://t.co/tj6SSwSzKR

— PlanB (@100trillionUSD) October 9, 2021

https://twitter.com/DocumentingBTC/status/1441128704566988815?s=09

Thank you to all of the open-source developers that contributed to the latest update to #Bitcoin Core 22.0, and #Bitcoin as a whole.#Bitcoin developers are unsung heros. pic.twitter.com/V0RcR28OOg

— Documenting ₿itcoin 📄 (@DocumentingBTC) September 14, 2021

Don't panic. As you are likely to regret most things you do while you are panicking, including panic sell. It's called "panic sell" for a reason.

— CZ 🔶 BNB (@cz_binance) September 8, 2021

Cuba will officially authorise #Bitcoin and crypto as payment methods.

— Bitcoin Archive (@BTC_Archive) August 27, 2021

Original post by: Tomer Strolight

Bitcoin loves being attacked. Bitcoin especially likes it when something tries to kill it. And it’s also very fond of people trying to ban it or trying to replace it with something “better”. When it comes to attacks on Bitcoin, the question isn’t “what’s going to kill Bitcoin?”; it’s “what’s going to make Bitcoin bigger, stronger, better, and more valuable?”.

Continue reading “Why Everything That Should Hurt Bitcoin Only Makes It Stronger”If you are hoping to preserve your wealth for a generation, @RicardoBSalinas suggests you invest in #bitcoin. The strategy is simple – choose the highest quality asset you can find and #hodl. https://t.co/ScRubzNBuR

— Michael Saylor⚡️ (@saylor) June 27, 2021

El Salvador has been a country suffering from civil war, economic ruin and high organized crime & murder rates for much of its modern life. Yet the 39 yr old El Salvadorian President, Nayib Bukele, who enjoys a super-majority of his party in parliament, in a world’s first, enacted law making Bitcoin legal tender in his nation.

Since 2001 El Salvador has done away with its local currency, the Colon, and instead decided to use The US Dollar as legal tender. With Bitcoin also now as legal tender, El Salvador made the best choice for securing the nation’s wealth going forward during these uncertain geopolitical times.

Stating the ease of payments and remittances which much of the country depends on, as well as the fact that many El Salvadorians aren’t banked, Bukele sees Bitcoin as the ideal solution.

It doesn’t stop with making Bitcoin legal tender. Bukele asked the state owned geothermal energy firm, LaGeo, to devise plans for offering Bitcoin mining facilities to Bitcoin miners who want to use the nation’s geothermal energy resources to run their mining farms. According to journalist Max Keiser, to be able to attract these miners, El Salvador is also offering permanent residence for Bitcoiners who are willing to dedicate BTC 3.

This, first-time, comprehensive all-round adoption of Bitcoin by a whole nation is the light Bitcoiners have been waiting to see in a long time, and just as the first domino falls, we also envision many other nations eventually following in El Salvador’s path.

If you worry the government might devalue 90% of your life savings and seize your dollars, #bitcoin fixes this. https://t.co/SSVfgf6Itk

— Michael Saylor⚡️ (@saylor) June 13, 2021

🚨 🚨 🚨 🚨 🚨 🚨 64,000,000 #USDT (64,000,000 USD) transferred from Tether Treasury to #Binancehttps://t.co/lXFTUJTNPp

— Whale Alert (@whale_alert) May 31, 2021

Original Post by: Bashir Barrage

Sit tight if you’re at a net loss now, buy more if have the cash. This is a regular occurrence every 4 years, they FUD on it during the bull-run to buy cheaper.

This chart is the most accurate price model for Bitcoin that I found. The Bitcoin price has a 94% standard deviation accuracy from the model here. From here, any downside in price will be minimal, the upside will be tremendous. It’s like a coiled spring.

See the investing section of the Bitcoin Resources to learn more about the Stock to Flow model.

Original Post by: Pete Rizzo

The Bitcoin Pizza Day story is one of the technology’s most historic tales, but even if you know the Bitcoin pizza price, these facts might surprise you.

May 22 is now forever known as Bitcoin Pizza Day, the holiday marking the date in 2010 when the first real-world good was bought with the first decentralized digital money.

Continue reading “Seven Surprising Facts About Bitcoin Pizza Day”With Randa and Tey

See also short film:

Original post by: Tyler Durden

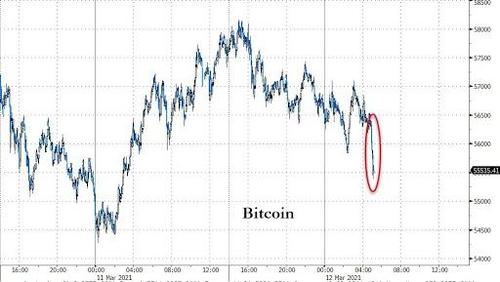

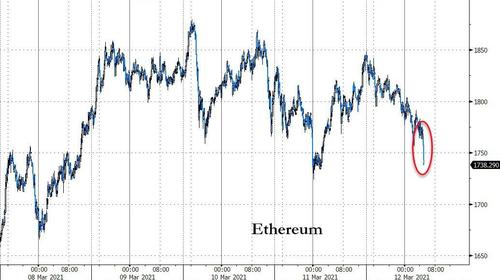

Crypto markets are sliding this morning following headlines that the CFTC is investigating whether the world’s largest cryptocurrency exchange Binance, which isn’t registered with the agency, allowed Americans to buy crypto ‘derivatives’ – which are regulated by the CFTC – and over ‘know your customer’ regulations.

Bitcoin slid back below $56k, plunging by $1000 in minutes.

Ethereum – the token behind the NFT craze – dipped below $1750…

In response to the probe, Binance told Bloomberg that it never comments on its communications with regulators, while adding that the company is committed to complying with rules. For instance, Binance blocks U.S. residents from its website and uses advanced technology to analyze deposits and withdrawals for signs of illicit transactions, the company said in a statement.

“We take a collaborative approach in working with regulators around the world and we take our compliance obligations very seriously,” Binance said. The CFTC declined to comment.

The investigation adds to the U.S.’s growing crackdown on crypto. The CFTC has already sued BitMEX for failing to register as a broker, with the exchange’s market share declining since it became a target of regulatory scrutiny. Coinbase Global Inc., the U.S.’s biggest crypto exchange, also disclosed last month that it’s responding to a wide-ranging CFTC probe.

Of course, such regulatory interventions always end up amounting to nothing as those who have followed crypto trading in the past five years know too well (only the Fed tightening monetary policy can burst the bitcoin bubble). Furthermore with a growing number of institutions now adopting crypto, it will be virtually impossible for regulators to squash the sector now that even vain Hollywood artists have adopted it in hopes of peddling their idiotic NFTs.

As such, we expect any dip in crypto to be promptly purchased by the growing number of institutions seeking a cheaper entry price.

By: Andreas Antonopoulos

See also short video: